- HOME

- Sustainability

- Governance

- Compliance

Compliance

Approach and Policies

Group Policy (Governance)

The Nomura Real Estate Group has positioned compliance with laws, regulations, corporate codes of conduct, and so on as a key management issue, in addition to the Group Policy, and formulated the Nomura Real Estate Group Code of Action as a compliance guide. Nomura Real Estate Holdings established the Risk Management Committee and Group Legal & Compliance Department, promotes ongoing education and training for officers and employees throughout the Group, and provides advice, guidance, and support to Group companies.

In an attempt to enhance its efforts, the Group signed and registered as a participating company in the United Nations Global Compact in May 2019. Based on the principles of the United Nation’s global initiatives, the Group will remain committed to all types of anti-corruption activities including extortion and bribery.

The Nomura Real Estate Group Code of Action

The Nomura Real Estate Group has formulated its Code of Action to define fundamental rules that Group officers and employees must adhere to. We review the effectiveness of the content of the Code of Action as appropriate, taking social circumstances and other factors into consideration, and any changes thereto are subject to decision by the Board of Directors.

Table of Contents of the Code of Action

Chapter 1 General provisions

Article 1 (Purpose)

Article 2 (Positioning)

Article 3 (Definitions)

Article 4 (Revision or abolition)

Chapter 2 Basic position

Article 5 (Awareness and behavior as a member of society)

Article 6 (Respect for basic human rights)

Article 7 (Observance of compliance)

Article 8 (Consideration for the global environment)

Article 9 (Corporate social responsibility)

Chapter 3 Behavior that gains customer trust

Article 10 (Providing highly safe, high-quality products and services)

Article 11 (Description of and risks relating to goods and services)

Article 12 (Response to consultations and complaints from customers)

Article 13 (Appropriate disclosure and provision of information to customers)

Article 14 (Management of customer information)

Chapter 4 Maintaining a fair relationship with business partners

Article 15 (Implementation of fair competition and fair trade)

Article 16 (Implementation of highly transparent transactions)

Article 17 (Offering moderate entertainment or gifts to business partners)

Article 18 (Infringement of intellectual property rights and prohibition of unauthorized use)

Article 19 (Management of information on business partners)

Chapter 5 Relationship with officers and employees

Article 20 (Respect for human rights of officers and employees)

Article 21 (Maintenance and improvement of work environment)

Article 22 (Prohibition of insider trading)

Article 23 (Sincere business activities)

Article 24 (Operational records and reports)

Article 25 (Management of company assets and information)

Article 26 (Reporting illegal or unethical behavior)

Chapter 6 Relationship with society

Article 27 (Disclosure of corporate information)

Article 28 (Offering entertainment or gifts to public officials, etc.)

Article 29 (Exclusion of anti-social forces)

Article 30 (Establishment, operation, and improvement of internal controls for proper business execution)

Chapter 7 Miscellaneous provisions

Article 31 (Preparation of guidelines)

Article 32 (Use of guidelines)

Article 33 (Application to overseas subsidiaries and affiliates)

Management

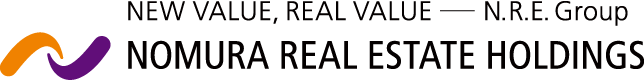

Compliance Promotion Framework

Nomura Real Estate Holdings has established the Risk Management Committee and Group Legal & Compliance Department to develop and implement a framework for compliance. In addition, compliance officers have been appointed at each Group company, and compliance leaders and compliance promoters have been appointed under compliance officers to ensure compliance throughout the Group.

Results

Performance Data

| Unit | FY2020 | FY2021 | FY2022 | ||

|---|---|---|---|---|---|

| Number of consultations received by the Group’s points of contact*1 | 45 | 39 | 52 | ||

| Consultations on harassment | ー | 26 | 31 | ||

| Consultations on other issues | ー | 13 | 21 | ||

| Number of serious legal violations, fines, and surcharges related to corruption and bribery, including facility payments | 0 | 0 | 0 | ||

| Number of violations of the Anti-Monopoly Act and the Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors | 0 | 0 | 0 | ||

| Anti-Monopoly Act (including other relevant laws) | Fines | yen | 0 | 0 | 0 |

| Investigations | 0 | 0 | 0 | ||

| Corruption, bribery, and other corrupt practices | Applicable cases | 0 | 0 | 0 | |

| Investigations | 0 | 0 | 0 | ||

| Tax payments by country and region*2 | Japan | Million yen | ー | 25,343 | 28,660 |

| UK | ー | 96 | 171 | ||

| Vietnam | ー | 56 | 62 | ||

| Thailand | ー | 3 | 0 | ||

| Ireland | ー | 1 | 0 | ||

| China | ー | 0.8 | 1.8 | ||

| Hong Kong | ー | 0.5 | 0.8 | ||

| Singapore | ー | 0.4 | 0.3 | ||

| Total | ー | 25,563 | 28,896 | ||

Total number of consultations

Source: Country-by-Country Report (CbCR)

Training Results Data for Fiscal 2022

| Types of Training | Target Participants | Number of Events | Number of Participants | Participation Rate (%) | |

|---|---|---|---|---|---|

| Compliance training (FY2022) | Group-wide training | Group employees | Bi-monthly | ー | 100 |

| Rank-specific training | Group executives | 1 | 137 | 100 | |

| Compliance officers | 1 | 12 | 100 | ||

| Group supervisors and compliance promotors | 10 | 788 | 100 | ||

| Newly promoted managerial employees of the Group | 1 | 166 | 100 | ||

| Mid-career hires of the Group | 4 | 236 | 100 | ||

| Compliance training for overseas business personnel (FY2022)*1 | Training through e-learning | New local hires at local subsidiaries | 1 | 9 | 100 |

| Newly appointed overseas business personnel | 1 | 31 | 100 | ||

| Officers and employees in departments related to overseas business | 1 | 31 | 100 | ||

| Online hybrid training (online + on-site) | Officers and employees in departments related to overseas business | 1 | 103 | 100 | |

Initiatives

Policy on Political Participation

In cases where the Group supports the activities of a political organization or makes political contributions, we act in compliance with relevant laws and regulations such as the Political Funds Control Act and Public Offices Election Act as well as the laws and regulations of each individual country and check our actions under the Group Code of Action.

Compliance Education Activities for Employees

The Group provides bimonthly web-based training on compliance for all Group employees, which in general covers the prevention of corruption. In addition, a handbook is distributed Groupwide for the purpose of deepening understanding of the Nomura Real Estate Group Code of Action, which describes corruption prevention and other matters.

Preventing Bribery, Graft, and Corruption

The Group prohibits the provision of entertainment or gifts to business partners incompatible with social common sense and to public officials (including foreign public officials) in pursuit of self-interest.

Group Code of Action (excerpt from the section regarding receipt or provision of entertainment or gifts from or to business partners)

・ Nomura Real Estate Group officers and employees shall not request, provide, or receive entertainment or gifts incompatible with sound business practices or social common sense.

・ No officer or employee shall use their professional position to request or accept benefits or favors from a business partner.

In terms of specific operations, we maintain records of when officers and employees have provided or received entertainment or gifts and they report them to supervisors.

The Risk Management Committee, a sub-organization of the Management Committee, regularly monitors, evaluates, and analyzes risks related to eliminating legal and regulatory violations, as well as unfair business practices, and to preventing corruption involving entertainment and gifts, as well as donations to politicians and political organizations. It also deliberates on basic response policies regarding risk prevention, response when risk occurs, and prevention of recurrence. In addition, a compliance promotor has been assigned to each department, office, and branch, and a system has been established to enhance the effectiveness of compliance activities in every workplace.

Apart from these measures, the Internal Audit Department conducts internal audits and operates an internal reporting system under which helplines have been exclusively established for employees of the Group and for suppliers, in an effort to detect bribery and other illegal acts at an early stage. The results of internal audits are regularly reported to the Board of Directors and Audit & Supervisory Committee.

Anti-Corruption and Anti-Bribery Measures When Selecting New Business Partners

The Legal & Compliance Department acts as a point of contact for starting business with a new business partner. To prevent corruption and bribery, risks are assessed by comprehensively investigating arrest records, relationships with anti-social forces, litigation history involving bribery, insider trading, unfair transactions, money laundering, and other references.

When selecting a new, higher risk overseas business partner, we generally adopt anti-bribery clauses in contracts. We determine the bribery risk in each country based on the above-mentioned items while referring to Transparency International’s Corruption Perceptions Index, and we comprehensively evaluate the transaction type, shareholding ratio, degree of involvement of joint venture partners in land acquisition, transaction size, and other factors. Following the results, we implement measures such as providing advice to business units. In addition, we periodically conduct and reassess corruption and bribery due diligence to ensure the prevention of corruption and regularly conduct anti-bribery training for officers and employees involved in overseas business operations.

Bribery Prevention Initiatives in Overseas Business

According to the Corruption Perceptions Index published by Transparency International, a non-governmental organization, the risk of corruption and bribery in our overseas operations is perceived to be higher than in Japan because many of the countries in which the Group operates are considered to be subject to a greater likelihood of corrupt practices. Consequently, the Group complies with the Guidelines for the Prevention of Bribery of Foreign Public Officials, established by the Ministry of Economy, Trade and Industry, and has formulated its own Policy on Anti-Bribery of Foreign Public Officials, which can be found on the Group website.

In light of the fact that the ratio of overseas business has increased dramatically since we established the policy, the Group has fully revised the policy in September 2022, believing that it is desirable for establishing an anti-corruption framework to more clearly demonstrate top management’s stance on legal compliance by publicizing the details of the Group’s anti-corruption policy and the implementation of its rules. In line with the overall revision, the policy has been renamed the Basic Policy on Prevention of Corruption Overseas to include a clause prohibiting Group officers and employees from bribing private business partners and requesting entertainment and gifts that deviate from business customs.

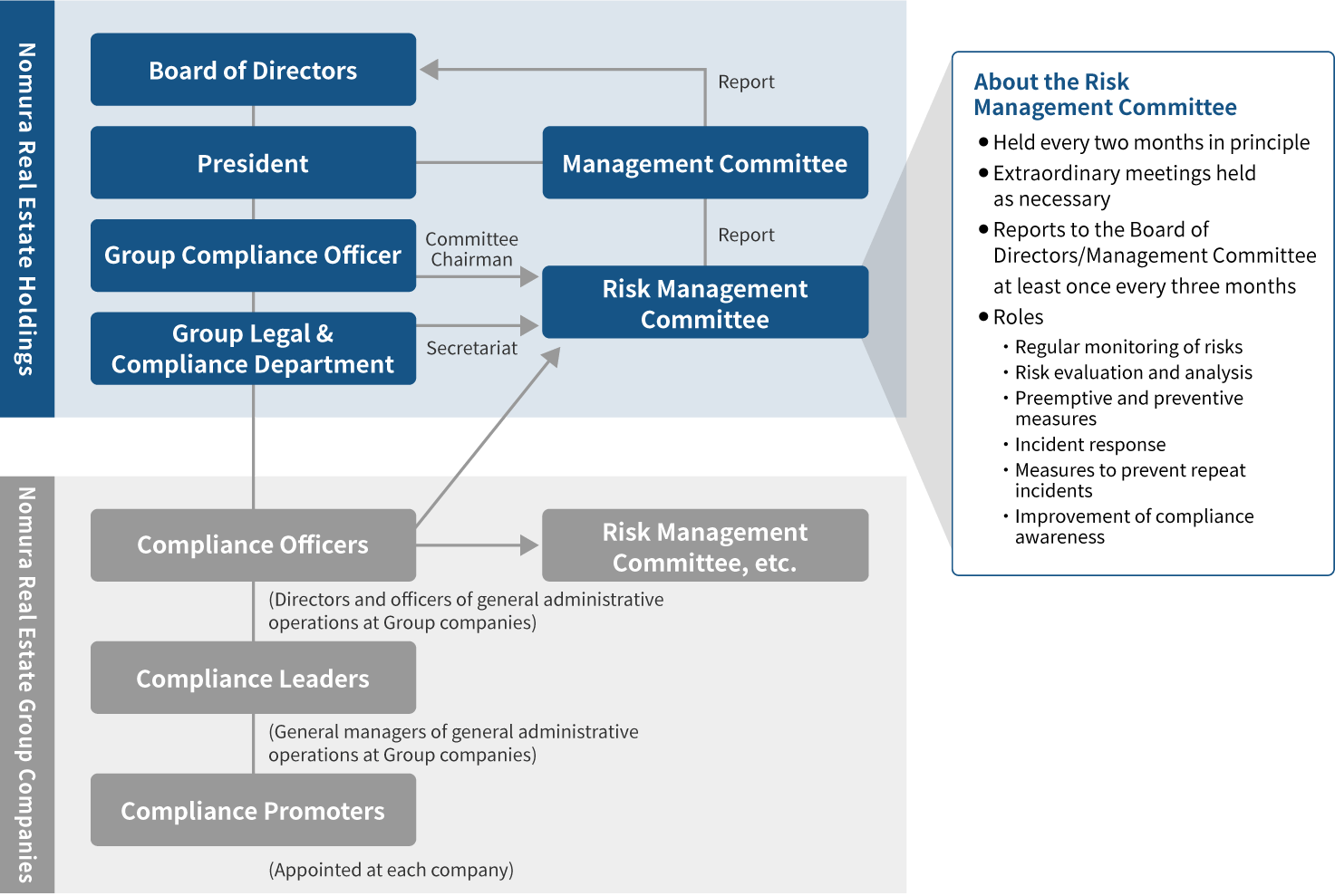

Under the revised policy, the Regulations on the Prevention of Bribery of Foreign Public Officials and the Anti-Bribery Guidelines have established specific rules on the provision of entertainment, gifts, and invitations, donations to foreign public officials, donations to foreign companies and organizations, and the use of agencies that we recognize as posing a high bribery risk. To avoid the risk of bribery, the Group follows a process in which the provision of entertainment, gifts, invitations, donations, and the use of agencies is approved by the executive officer in charge of the Legal & Compliance Department of Nomura Real Estate Holdings, only when the strict requirements stipulated for each case under the guidelines and the monetary value standards determined by the laws and regulations of each country have been met.

The above regulations also prohibit the payment of small amounts (facility payments) for the sole purpose of facilitating official procedures.

When selecting a new business partner overseas, the Group makes every effort to prevent corruption. In addition to adopting anti-bribery clauses in contracts, we seek to understand the bribery risk of each country by referring to the above-mentioned Corruption Perceptions Index to conduct corruption and bribery due diligence and periodic reviews as needed, based on an overall consideration of the transaction type, shareholding ratio, degree of involvement of joint venture partners in land acquisition, transaction size, and other factors. In addition, the Group also conducts periodic training on the prevention of bribery for officers and employees involved in overseas business operations.

Anti-Bribery Guidelines for Overseas Business (Table of Contents)

Chapter 1 General Provisions

Article 1 Purpose

Article 2 Conduct Related to Duties

Chapter 2 Entertainment and Gifts

Article 3 Notes on Entertainment and Gifts

Article 4 Acceptable Entertainment and Gifts

Article 5 Entertainment and Gifts at Joint Ventures

Article 6 In-house Socializing at Joint Ventures

Chapter 3 Invitation

Article 7 Notes on Invitations

Article 8 Acceptable Expenses for Invitations

Chapter 4 Donations

Article 9 Notes on Donations

Chapter 5 Use of Agencies, etc.

Article 10 Notes on the Use of Agencies, etc.

Chapter 6 Cases Not Involving Bribery

Article 11 Emergency Response

Chapter 7 Special Notes

Article 12 Special Notes

Reference: Article 10. Notes on the Use of Agencies, etc.

Informing Business Partners about Anti-bribery

To ensure fair and transparent business activities throughout the supply chain, the Group requests that suppliers understand and cooperate with the contents of the Nomura Real Estate Group Procurement Guidelines, which include items concerning fair business practices. The guidelines are always available on the website, and suppliers are notified of any revisions as they are made.

Nomura Real Estate Group Procurement Guidelines (Excerpt)

・ In relationships with public employees and the like (including deemed public employees and foreign public employees), maintain sound relationships and do not provide entertainment or exchange gifts in ways that conflict with the National Public Service Ethics Act and Regulations, related national and local laws and regulations, etc.

・ Do not request, provide, or receive from suppliers entertainment or gifts that deviate from sound business customs and social norms.

・ Exclude all relationships with anti-social forces and groups that pose a threat to social order and security or obstruct fair economic activities. Also, resolutely challenge and completely reject any transactions with or unreasonable demands by such forces or groups.

・ Comply with anti-monopoly, prevention of unfair competition, and intellectual property rights legislation and related laws and regulations and endeavor to fairly treat suppliers, competitors, and others without engaging in acts constituting abuse of a dominant market position, blocking of transactions, or other such conduct

・ Do not infringe or improperly use copyright, patents, trademark rights, design rights, or other intellectual property rights.

・ Do not participate in money laundering, embezzlement, fraud, or any other form of corrupt conduct.

・ Carry out appropriate disclosure to customers and society and also endeavor to appropriately provide the necessary information.

Implementing Fair Competition and Fair Trade, and Addressing Conflicts of Interest

The Nomura Real Estate Group Code of Action sets forth rules on maintaining fair relationships with business partners. The areas covered by the rules include the implementation of fair competition and fair trade and implementation of highly transparent trade, to ensure compliance with the Anti-Monopoly Act, Act Against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors, and other laws and regulations. Moreover, in the selection of business partners, we strive to assess a wide range of factors comprehensively and fairly, including quality, price, track record, and reliability. Conflicts of interest are regulated by law from the viewpoint of ensuring the fairness of transactions, and the Group has established internal rules for avoiding conflicts of interest in accordance with the Companies Act. As a specific measure, when directors and executive officers engage in non-routine transactions with Nomura Real Estate Holdings or its Group companies, prior approval is required from the Board of Directors or the Management Committee as necessary. Non-routine transactions with our major shareholders, their parent Company, affiliates, or subsidiaries must also undergo an approval process or reporting with the Board of Directors or the Management Committee, as necessary.

Excluding Anti-social Forces from Business Relationships

The Nomura Real Estate Group has established Article 29 within its Code of Action that prohibits business transactions with anti-social forces or related organizations. It is our strict policy to exclude anti-social forces from our business relationships. In line with this policy, we issued a manual that details specific responses and have designated a department to ensure organizational responses by Nomura Real Estate Holdings and are collaborating with Group companies. We have appointed personnel responsible for preventing improper requests at each Group company. In addition, we consult and coordinate with legal counsel, the police, and other specialized external organizations to ensure that anti-social forces are excluded from involvement in our business activities and to prevent any harm caused by such anti-social forces.

Guidelines on Social Media

The Nomura Real Estate Group Code of Action stipulates that all officers and employees must exhibit an awareness of being a member of society and exemplify a high level of ethics following the norms of society at all times. We implement periodic activities, including compliance training, which are intended to raise awareness and provide information on areas of caution and risks relating to the posting information on social media. We have also disclosed the Group’s Social Media Policy.

Complying with Regulatory Requirements and Raising Awareness

The Nomura Real Estate Group has developed a compliance program every year and provides compliance training to officers and employees all year round in a planned manner in order to ensure compliance and the penetration of compliance awareness among officers and employees.

The Group also distributes the Nomura Real Estate Group Procurement Guidelines to its business partners and requests their compliance with fair business practices. In fiscal 2022, we conducted a survey to monitor 300 companies that ranked high in terms of the value of their annual transactions with the Group during the fiscal year, including construction and maintenance companies. We also engaged directly with ten of these companies. Looking ahead, will continue to work closely with suppliers to ensure compliance.

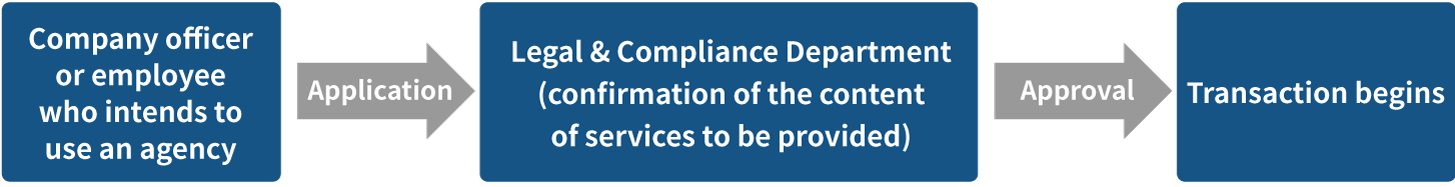

The Nomura Real Estate Group Helpline

The Nomura Real Estate Group set up the Nomura Real Estate Group Helpline based on the Whistle-blowing System Operation Rules to establish a system for appropriately responding both to consultations and reports on legal violations, misconduct, money laundering, bribery, embezzlement, fraud, or any other corrupt conduct committed at the organizational or individual level. We have established internal points of contact (Risk Management Committee chairperson and Group Legal & Compliance Department) and external points of contact (lawyers and outsourcing contractors) to make it easy for informants and users to use the helpline. For overseas offices, we have a system for responding to consultations and reports in the language of the relevant countries. We also protect whistleblowers such as by imposing confidentiality obligations on those involved in helpline operations, including those who cooperate with investigations, and by not prejudicially treating informants for making a report.

We have also established the Helpline for Business Partners for corporate customers and others with whom we have a business relationship to ensure the implementation of fair transactions.

The Risk Management Committee chairperson reports the received consultations and reports to Audit & Supervisory Committee members selected by the Audit & Supervisory Committee, who promptly investigate, verify facts, and mete out strict punishment for any serious violations, in accordance with internal rules.

There are no pending lawsuits related to this helpline as of March 31, 2022.

Helpline for Business Partners (Japanese only)

Basic Approach to Tax Matters

The Group is committed to enhancing tax transparency by ensuring that each Group company takes the initiative to comply with all laws and regulations, pay appropriate taxes in all countries in which they operate, and refrain from activities intended to avoid taxation, such as unfair tax planning, use of tax havens, and transfer pricing manipulation.

We maintain sound and normal relationships with tax authorities in various countries, and do not provide unfair advantages. In the event of any disagreements with tax authorities, we strive to resolve any issues by engaging in constructive communication and taking appropriate measures.

Management System for Tax Matters

Each Group company takes the initiative in understanding the taxation system and taking appropriate measures. When revisions in the tax system significantly impact the Group, details are closely examined and reported to the Management Committee, which is responsible for integrated management. In our overseas operations, revisions in the tax system of countries in which we operate are confirmed and periodically reported to the Overseas Business Monitoring Committee. Furthermore, the Monitoring Committee reports its findings to the Management Committee and the Board of Directors as needed.

Compliance with the Anti-Monopoly Act, the Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors, and Violation of Laws and Regulations Regarding Corruption and Bribery

Over the past four years since the end of March 2022, the Group has not been subject to any administrative penalties (fines or settlement payments) for violations of the Anti-Monopoly Act or the Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors. Furthermore, in fiscal 2022, there were no significant legal violations, fines, or penalties related to corruption or bribery including facility payments.

Measures on Non-Compliance

In fiscal 2022, there were no compliance violations that had a material impact on the Group’s operations. Also, no employees were disciplined for violating the Anti-Corruption and Anti-Bribery Policy. Employees found to be in non-compliance will be subject to disciplinary action, including a reduction in salary, in accordance with the internal rules.

Sustainability

- The Nomura Real Estate Group’s Stance on Sustainability

- Climate Change and the Natural Environment

- Society and Employees

- ESG Data