- HOME

- Sustainability

- Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Responding to the Task Force on Climate-related Financial Disclosures (TCFD)

Understanding Climate Change

Climate change is currently recognized as one of the most significant threats to the sustainable development of global society. The Fifth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), released over the course of 2013 and 2014, states that human activities are extremely likely (at least 95%) to be the main cause of global warming and climate change. Subsequently, the IPCC Sixth Assessment Report, released in August 2021, states that it is unequivocal that human activities are the main cause of global warming and climate change.

Based on these scientific views, a debate on how to deal with climate change has raged across the world. At the Conference of the Parties (COP21) of the United Nations Framework Convention on Climate Change (UNFCCC) in 2015, the Paris Agreement was adopted to pursue efforts to limit global warming to well below 2, preferably to 1.5°C, compared to pre-industrial levels. Under the Paris Agreement, countries have set targets for reducing greenhouse gas (GHG) emissions and are implementing a variety of climate change-related measures. For example, in Japan, where our Group mainly operates, the government declared its goal in October 2020 to achieve carbon neutrality by 2050.

The impact of climate change on the global economy and corporate activities is becoming increasingly severe with each passing year. Accordingly, shareholders and investors are facing a growing urgency to assess how the businesses and plans of each company will be affected by climate change. Recognizing the need for a common global framework that facilitates an appropriate assessment of the risks and opportunities of climate change for each company, the TCFD was established to promote disclosure of information on climate change in response to requests from the G20 and national central banks. It released its final report in June 2017 and has been encouraging companies to disclose information on climate change.

Approach and Policies

In light of these circumstances, the Group established its sustainability policy “Earth Pride,” which describes its vision of 2050.

Under our Group vision “New Value, Real Value,” the Group has been promoting its business activities through the collaboration of real estate development and real estate-related services. The sustainability policy is our commitment to the Earth—to make it a planet we can be proud of toward the future, specifically 2050—when conducting our corporate activities.

The concept of Earth Pride is based on the three themes that the Group values: pursuing humanity, maintaining harmony with nature, and building the future together.

This sustainability policy verbalizes the Group’s vision of 2050 as a corporate group that realizes a sustainable society and corporate growth. Numerous people, including middle-level and younger employees, those in managerial positions, the management team of the Group, external institutional investors and financial institutions, our clients, and business partners and experts, provided input in formulating this policy.

To realize this vision of 2050, we have identified five priority issues (materiality) that should be addressed by 2030. These are diversity and inclusion, human rights, decarbonization, biodiversity, and circular design.

Targets

| Climate Change and the Natural Environment | Contribution to the urgent global issue of reducing CO2 emissions, biodiversity preservation, and the realization of a circular society that contributes to CO2 reduction | |||||

|---|---|---|---|---|---|---|

| Decarbonization | Initiatives in energy saving, low-carbon business, and utilization of renewable energy <Target: 35% reduction in Scopes 1, 2, and 3 by FY2030 compared to FY2019 > |

|||||

| Biodiversity | By restoring the forest cycle in Japan, contribute to CO2 absorption and the natural environment through urban afforestation and forest preservation, thus enabling rich biodiversity | |||||

| Circular Design | Contribute to a decarbonized society and a circular economy through urban development and service provision that incorporate longer lives of properties, recycling, and sharing | |||||

| Society and Employees | Strengthening the foundation for promoting sustainability for co-creation that transcends organizations and business categories | |||||

|---|---|---|---|---|---|---|

| Diversity and Inclusion | Create an organization that enables diverse workers, including women and foreign nationals, with various backgrounds and values to make meaningful contributions | |||||

| Human Rights | Solidify a corporate foundation of mutual respect for the dignity and basic human rights of every employee and business partner | |||||

Climate Change and the Natural Environment

We contribute to address the global issue of climate change through urban development and the provision of products and services based on the collaboration of real estate development and real estate-related services. We also specified priority issues that could lead to the preservation of the natural environment. In addition, the Group has proactively participated in international initiatives such as obtaining approval from the SBT initiative (35% reduction from fiscal 2019), supporting the TCFD, and joining RE100.

Decarbonization

We reduce total CO2 emissions in the properties developed by the Group through the promotion of energy saving, low carbon, and renewable energy.

Main initiatives:

We aim to further improve energy conservation performance ensuring the level of performance equivalent to the ZEH/ZEB oriented standards.

We conduct research and development to promote low-carbon materials through co-creation with construction companies and building materials makers.

We contribute to increasing renewable power generation that achieves additionality such as installing solar panels on the roofs of buildings developed by the Group, logistics facilities, and detached housings.

We aim to respond to climate change through urban development. For instance, we will achieve carbon neutrality in the Shibaura 1-Chome Project (the south tower to be completed in fiscal 2024 and the north tower to be completed in fiscal 2030). We will also create a next-generation energy exchange facility in the project with the Research Center for Advanced Science and Technology, The University of Tokyo.

Approach and Policies on Climate Change

The Nomura Real Estate Group uses land and other natural resources and energy in the course of conducting business activities, and it is fully aware that the substantial impact of climate change on its business continuity is a major management issue. In September 2020, Nomura Real Estate Holdings, Inc. (head office: Shinjuku-ku, Tokyo; president and Group CEO: Satoshi Arai) announced its endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and joined the TCFD Consortium of Japan.

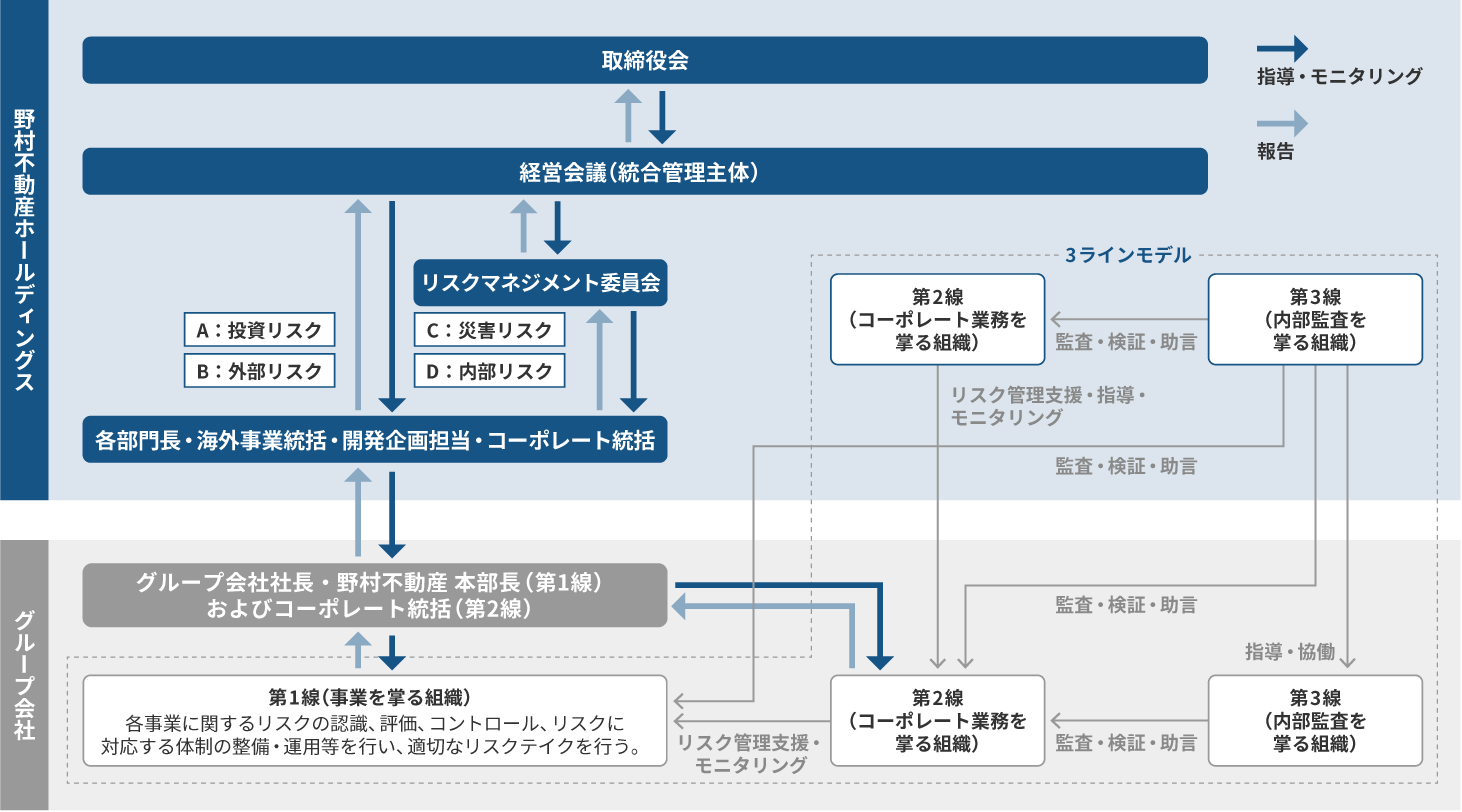

Governance

The Sustainability Committee, which comprises Nomura Real Estate Holdings and Group company directors and others, and is chaired by the Nomura Real Estate Holdings president and Group CEO, deliberates Group-wide policies and targets related to climate change. The committee is positioned as a subordinate committee of the Management Committee and holds at least three meetings each year to review risks and opportunities associated with climate change and to examine and monitor the Group’s GHG reduction targets. Details of deliberations made by the committee are, in principle, reported to the Board of Directors and Management Committee at least once every six months. In addition, any key matters related to the Group’s management are reported to the board and committee as necessary.

As mentioned above, the Nomura Real Estate Holdings president and Group CEO is responsible for promoting measures to address sustainability and climate change throughout the Group. The Group CEO is the chief executive officer of the Board of Directors and Executive Committee and is responsible for making the best decisions to achieve the sustainable growth of the Group as a company, including addressing sustainability and climate change, and for executing key related operations.

In addition, since fiscal 2019, the Group has been requiring that directors, including the CEO, maintain a strong awareness of the need to adapt to changes in society and the needs of the times under their selection criteria, and it has incorporated the sustainability and ESG perspectives, such as climate change, into decisions on director compensation. In our director compensation system, the degree of achievement of sustainability targets, including measures to respond to climate change, in the business areas under the control of each director, is incorporated into the evaluation criteria. Also, the system calculates variable compensation according to the degree of achievement of roles related to sustainability and ESG assigned to each director.

Starting in fiscal 2022, the policy for deciding on the details of the compensation and other benefits for each individual director, excluding Audit & Supervisory Committee members, will be revised, and the details and calculation method for performance indicators and other considerations relating to bonuses as monetary compensation would retain a central emphasis on performance evaluation in terms of consolidated business profit and other factors, as well as including an evaluation based on non-financial indicators (e.g., sustainability factors). The reason for this is to raise director awareness of sustainability. For fiscal 2022, we have conducted an evaluation using non-financial indicators based on the Building Energy-efficiency Index*.

This index evaluates the energy-saving performance of buildings based on the energy-saving standards of the Act on the Improvement of Energy Consumption Performance of Buildings (Building Energy Efficiency Act). It indicates the level of primary energy consumption of a given building.

Strategies

Upon considering climate change response strategies, the Group conducted a qualitative scenario analysis based on the IPCC Sixth Assessment Report and the details of the Paris Agreement. In the analysis, we examine the risks and opportunities that may be presented to the Group as a result of climate change and consider and implement strategies and policies that capture such risks and opportunities.

Scope of Analysis

The analysis covers all businesses of the Group, including the Residential Development Business Unit (development and sale of condominiums and detached housing), the Commercial Real Estate Business Unit (development, leasing, and sale of office buildings, retail facilities, logistics facilities, and hotels), the Overseas Business Unit (development, leasing, and sales of properties overseas), the Investment Management Business Unit (management of REITs and private funds), the Property Brokerage & CRE Business Unit (real estate brokerage), and the Property & Facility Management Business Unit (real estate management) and Other.

The scope of calculation of GHG emissions includes all of Scope 1, 2, and 3 emissions generated by the Group.

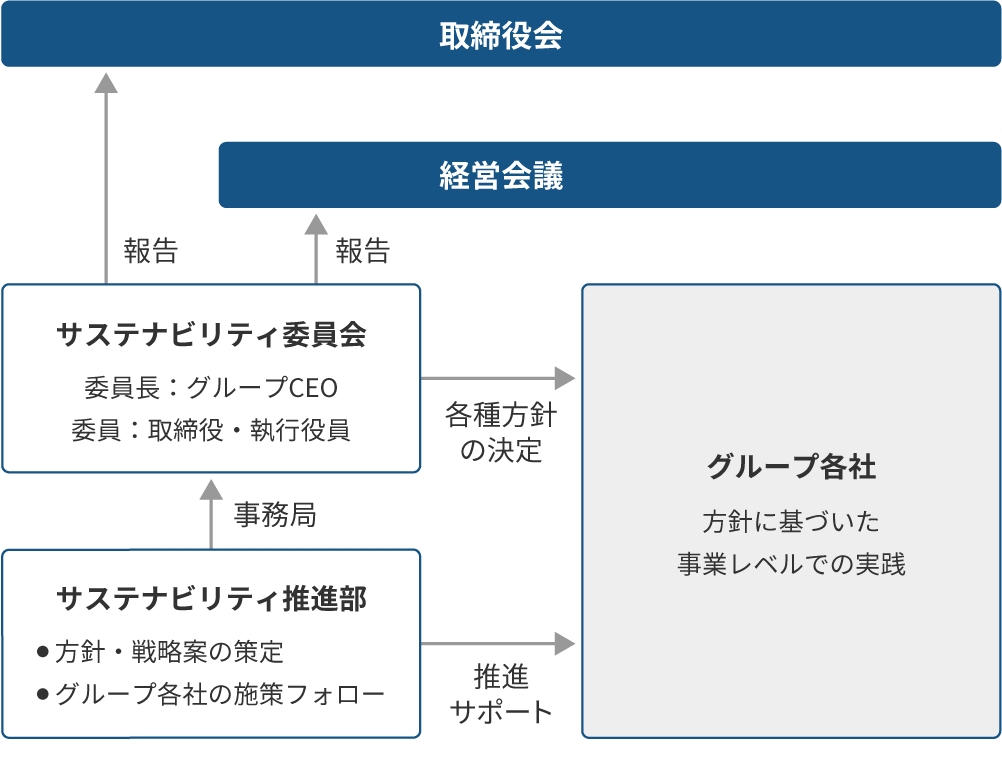

Setting out scenarios

In the scenario analysis, the Group adopted the 1.5°C and 2°C scenarios, assuming the achievement of the Paris Agreement and the realization of a decarbonized society. The 4°C scenario, a model in which climate change countermeasures do not make sufficient progress and the severity of natural disasters increases as a result, is also considered. The following documents were the main materials referred to in anticipating possible changes to the global environment under each scenario.

- ・Representative Concentration Pathway (RCP) 2.6 and 8.5 scenarios in the UN IPCC Fifth Assessment Report

- ・United Nations IPCC Sixth Assessment Report (2021)

- ・Sustainable Development Scenario (SDS) and Stated Policies Scenario (STEPS) in the IEA World Energy Outlook (2020)

Possible changes to the global environment under each scenario

Under each scenario, we have established an image of the world in 2050 for the 1.5°C, 2°C, and 4°C scenarios.

Identification of Risks and Opportunities

The TCFD recommendations classify climate change-related risks and opportunities into transition risks and opportunities (policy and legal, technology, market, and reputation) and physical risks and opportunities (acute and chronic). The Group has accordingly identified the impact of each risk and opportunity on the Group in terms of financial impact (classified as small, medium, or large) and in terms of time (classified as long, medium, or short).

| Financial impact Degree of impact standard setting |

Degree of impact setting | Degree of impact on consolidated business profit |

FY2023/3 Results (amount/year) |

|---|---|---|---|

| Large | 10%– | ¥10.5 billion– | |

| Medium | 5%–10% | ¥5.2–¥10.5 billion | |

| Small | –5% | –¥5.2 billion |

| Timeline setting | Duration of impact setting | Forecast period |

|---|---|---|

| Short term | –2025 | |

| Medium term | –2030 | |

| Long term | –2050 |

| Category | Items | 1.5℃ | 2℃ | 4℃ | |||||

|---|---|---|---|---|---|---|---|---|---|

| Large category | Small category | Degree of impact | Duration | Degree of impact | Duration | Degree of impact | Duration | ||

| Risks | Transition risks | Policies and regulations | Increase in construction costs to meet ZEH/ZEB standards | Small | Medium to Long | Small | Medium | None | None |

| Increase in the carbon tax imposed on the Company’s own emissions (Scopes 1 & 2) | Small | Medium to Long | Small | Medium | Small | Short | |||

| Market | Rise in the burden of carbon tax in development costs (Scope 3 Category 1) | Medium | Medium to Long | Medium | Medium | Small | Short | ||

| Investments in energy-efficient equipment | Small | Medium to Long | Small | Medium | None | None | |||

| Reputational | Loss on annual leases of non-ZEB properties | Medium | Medium | Medium | Medium | None | None | ||

| Technical | Change in reliability of businesses and products | ー | |||||||

| Physical risks | Acute | Increase in losses due to intensifying wind and water damage (floods) | Small | Long | Small | Long | Small | Long | |

| Chronic | Damage from rising sea levels (floods) | Small | Long | Medium | Long | Medium | Long | ||

| Damage from rising temperatures (extremely hot days, on which the temperature rises above 35℃) | Small | Long | Small | Long | Small | Long | |||

| Opportunities | Transition opportunities | Policy and regulatory | Enhancement of subsidy systems, including for energy-saving technologies, ZEBs, and ZEHs | ー | |||||

| Market | Solar power earnings | Small | ー | Small | ー | ー | ー | ||

| Reputational | Increase in ZEB property sales earnings | Medium | Medium | Medium | Medium | None | None | ||

| Increase in ZEH property sales | Large | Medium | Large | Medium | None | None | |||

| Technical | Changes in the reliability of business and products | ー | |||||||

| Decrease in funding procurement costs due to a reduction in CO2 | Small | Short | Small | Short | Small | Short | |||

| Decrease in heating costs due to higher energy-efficient performance | Small | Medium | Small | Medium | Small | Medium | |||

Items that are currently difficult to quantify are marked "—".

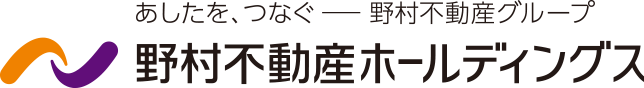

Risk Management

| Risk Category | Definition | |

|---|---|---|

| A | Investment risks | Risk related to individual investments (real estate investment, strategic investment (M&A), etc.) |

| B | External risks | Risks related to external factors influencing business |

| C | Disaster risks | Risks generated by disasters that have a large impact on customers and business continuity |

| D | Internal risks | Operational risks occurring at the company and each Group company |

To discuss various risks related to Group management, the Company has prescribed the Management Committee as the integrated risk management body and operates a system to regularly monitor, evaluate, and analyze the state of main risks and provide necessary guidance and advice to each business unit and Group company while regularly reporting details to the Board of Directors. The committee, which is the integrated management body, directly monitors investment risks and external risks, while the Risk Management Committee, established as a subordinate organization of the Management Committee, conducts regular monitoring, evaluation, and analysis of disaster risks and internal risks and discusses basic response policies regarding risk prevention, responses when risk occurs, and prevention of recurrence. The Board of Directors and the Management Committee manages and supervises sustainability-related risks, including climate change, and the Sustainability Committee, which is under the Management Committee, deliberates said risks as appropriate. In addition, each Business Unit manages individual matters related to their businesses, such as business planning and product planning.

Specifically, they survey and assess each individual risk related to the market (affecting customer companies and consumers) as well as laws and regulations (such as for construction and real estate), and reflect them as appropriate in plans for businesses and products. Of the matters considered by each Business Unit, ones that significantly impact the entire Group are reported as appropriate to the Board of Directors, Management Committee, Sustainability Committee, or Risk Management Committee depending on the content.

Metrics and Targets

The Group has set the following targets to promote its response to climate change and has also identified the indicators described below for greenhouse gases.

| Item | Scope | 2030 Target | Unit | |

|---|---|---|---|---|

| Long-term: Achieve carbon neutrality by 2050 | Group-wide Scope 1, 2, and 3*1 | 0 | kt-CO2 | |

| Rate of reduction in total CO2 emissions | KPIMedium-term: by 2030 Total reduction rate (compared to the fiscal 2019) (certified by the SBT Initiative in November 2020) |

Group-wide Scopes 1, 2, and 3 (Categories 1 and 11)*2 | 35 | % |

| Short-term: by 2025 Total reduction rate (compared to the fiscal 2019) |

15 | |||

| Reduce energy use | Medium-term: by 2050 Use of electricity derived from renewable energy sources (joined RE100 in January 2022) |

Group-wide | 100 | % |

| Short-term: by fiscal 2023 Use of electricity derived from renewable energy sources*3 |

All leasing properties owned by Nomura Real Estate Development | |||

| KPIEnergy conservation performance indicators in new buildings: ZEH/ZEB-oriented standards | Maintain same level | ー | ||

Scope 1: Direct emissions from fuel combustion; Scope 2: Indirect emissions associated with purchased electricity and heating; Scope 3: Indirect emissions other than those in Scopes 1 and 2

In Scope 3, Category 1 (emissions from construction of buildings, etc.) and Category 11 (emissions from use of sold products) are targeted, which cover approximately 88.45% of the Scope 3 emissions in fiscal 2020.

Excludes leasing properties (including the portion used by tenants) for which Nomura Real Estate Development has concluded direct electricity supply contracts with power companies, properties in which Nomura Real Estate Development owns units or are jointly owned with other parties, and properties planned to be sold or demolished, as well as the common use areas of some rental housing.

The Group will in principle promote measures to respond to climate change by collecting data on GHG (CO2) emissions for all properties owned and sold by the Group as a whole and reducing the GHG emissions of the entire Group by compiling and monitoring the results. We will also look into setting an ultra-long-term target to achieve carbon neutrality by 2050. For the results related to climate change, please refer to the following.

Medium- to Long-Term Targets*

(Unit: kt-CO2)

| FY2019 (base year) |

FY2020 | FY2021 | FY2022 | ||||

|---|---|---|---|---|---|---|---|

| Reduction Rate | Reduction Rate | Reduction Rate | |||||

| Scope1 | 23 | 20 | -14.8% | 21 | -8.8% | 23 | -0.5% |

| Scope2 | 126 | 112 | -11.7% | 107 | -15.3% | 74 | -41.1% |

| Scope 1, 2 (totals) | 150 | 132 | -12.2% | 129 | -14.3% | 98 | -34.7% |

| Scope 3 Category 1: Purchased products and services | 969 | 453 | -53.2% | 702 | -27.6% | 698 | -28.0% |

| Scope 3 Category 11: Use of products sold | 2,203 | 834 | -62.1% | 1,214 | -44.9% | 1,170 | -46.9% |

| Scope 3 (totals) Note: Targeted only |

3,172 | 1,287 | -59.4% | 1,916 | -39.6% | 1,868 | -41.1% |

Data for previous years has been corrected retrospectively to improve accuracy.

Third-party Assurance

We have asked Lloyd’s Register Quality Assurance Ltd. to provide assurance on the GHG emissions and energy use data for the entire Group.

Reference: Performance on Other Climate Change-Related Issues

(1) GHG emissions performance in Scopes 1 and 2

(Unit: t-CO2)

| FY2019 (Base Year) |

FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| Scope1 | 23 | 20 | 21 | 23 |

| Scope2 | 126 | 112 | 107 | 74 |

| Scope 1, 2 (totals) | 150 | 132 | 129 | 98 |

(2) GHG emissions performance by all items in Scope 3*1

(Unit: kt-CO2)

| FY2019 (Base Year) |

FY2020 | FY2021 | FY2022 | ||||

|---|---|---|---|---|---|---|---|

| Reduction Rate | Reduction Rate | Reduction Rate | |||||

| 1: Products and services purchased | 969 | 453 | -53.2% | 702 | -27.6% | 698 | -28.0% |

| 2: Capital goods | 71 | 97 | +37.5% | 159 | +124.0% | 111 | +56.1% |

| 3: Fuel- and energy-related activities not included in Scopes 1 and 2 | 27 | 24 | -9.5% | 24 | -11.3% | 24 | -10.7% |

| 4: Transportation and delivery (upstream) | 4 | 3 | -22.5% | 4 | +9.4% | 6 | +69.7% |

| 5: Waste generated by businesses | 6 | 5 | -22.5% | 7 | +9.4% | 11 | +69.7% |

| 6: Business trips | 1 | 0*2 | -34.1% | 0*2 | -32.2% | 1 | -29.3% |

| 7: Employers’ commuting | 2 | 2 | +0.6% | 1 | -20.0% | 1 | -32.8% |

| 8: Lease assets (upstream) | ー | ー | ー | ー | ー | ー | ー |

| 9: Transportation and delivery (downstream) | ー | ー | ー | ー | ー | ー | ー |

| 10: Processing of products sold | ー | ー | ー | ー | ー | ー | ー |

| 11: Use of products sold | 2,203 | 834 | -62.1% | 1,214 | -44.9% | 1,170 | -46.9% |

| 12: Disposal of products sold | 62 | 19 | -68.7% | 38 | -37.9% | 38 | -38.8% |

| 13: Lease assets (downstream) | 19 | 14 | -26.2% | 13 | -28.8% | 12 | -36.9% |

| 14: Franchise | ー | ー | ー | ー | ー | ー | ー |

| 15: Investments | ー | ー | ー | ー | ー | ー | ー |

| Scope 3 (totals) | 3,367 | 1,456 | -56.8% | 2,167 | -35.6% | 2,075 | -38.4% |

Data for previous years has been corrected retrospectively to improve accuracy.

Less than 1

(3) Energy use performance in properties subject to reporting under the Act on the Rational Use of Energy

| FY2019 | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| Energy consumption (MWh) | 422,490 | 381,817 | 379,428 | 382,231 |

| Energy use intensity (MWh/m2) | 0.208 | 0.184 | 0.182 | 0.186 |

For the calculation of the energy use intensity, energy use is divided by the gross floor area of a property subject to reporting under the Act on the Rational Use of Energy (property subject to reporting on energy saving).

The Group is striving to reduce CO2 emissions through the three approaches of energy conservation, low-carbon buildings, and renewable energy.

(4) Energy Conservation Initiatives

(4-1) ZEH (Net Zero Energy House) initiatives

The Group is developing ZEHs* in condominiums from the perspective of comprehensive environment impact reduction.

In fiscal 2021, the PROUD Musashi Shinjo Station Marks was adopted as a Ministry of Economy, Trade and Industry Super high-rise ZEH-M Demonstration Project, and in fiscal 2022, the Aoyama 2-Chome Plan was adopted as a Ministry of the Environment High-rise ZEH-M Support Project. The Group will ensure ZEH- and ZEB-oriented standards in all new buildings by 2030. We will also start putting efforts into detached housings from fiscal 2022.

Homes designed to achieve a net zero annual primary energy consumption by greatly improving the insulation performance of the building envelope, installing highly efficient facilities and equipment to maintain the quality of the indoor environment, substantially reducing energy consumption, and then introducing renewable energy.

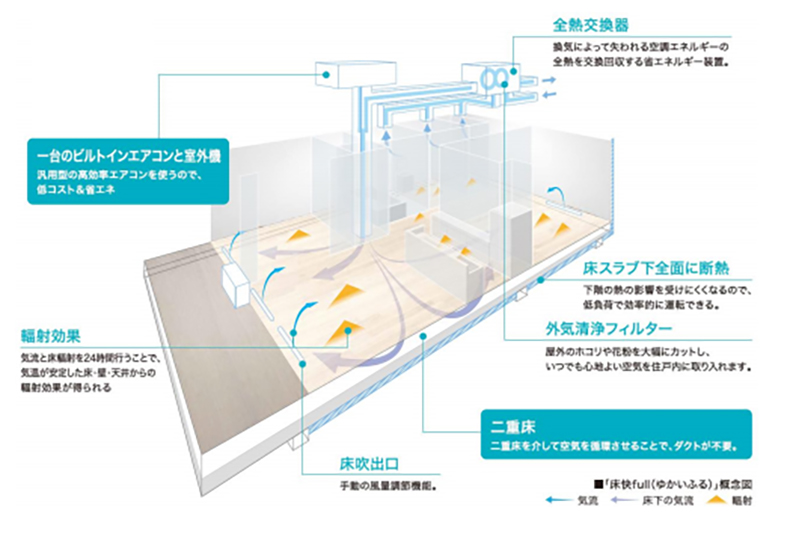

“Yukai-full” Offering Both Environmental Performance and Healthy, Comfortable Living

In order to deliver the energy-saving performance of ZEH-M, we have adopted “Yukai-full” in some of the PROUD properties. The “Yukai-full” system uses a double floor as a pathway for heating, cooling, and ventilation, sending air conditioner breezes and fresh outside air throughout the entire dwelling, which keeps the entire space comfortable 24 hours a day, 365 days a year. This contributes to maintaining the overall health of the residents by reducing the risk of heat stress and heatstroke. In addition, the system can be operated at a lower temperature setting than usual when residents are out of the building, thereby saving energy while maintaining comfort and improving energy efficiency.

(4-2) Initiatives for obtaining green building certifications

The Group seeks to obtain environmental, green building certifications for new construction and owned properties including DBJ Green Building*1, LEED*2, CASBEE*3, and BELS*4.

Quantified target: acquisition rate of green building certifications for newly constructed fixed assets and income-producing properties (excluding rental housing): 100%

DBJ Green Building

A certification system, run by the Development Bank of Japan, that is aimed at promoting real estate that contributes to the environment and society.

LEED

A certification system developed and run by the U.S. Green Building Council (USGBC). Certification is granted to environment-friendly buildings.

CASBEE

A comprehensive assessment system for built environment efficiency. It includes a certification system run by the Institute for Built Environment and Carbon Neutral for SDGs (IBEC) and others, and assessment systems by local governments.

BELS

A building-housing energy efficiency labeling system established by the Ministry of Land, Infrastructure, Transport and Tourism. The energy efficiency of properties and housing is evaluated and certified by a third-party assessment organization.

(4-3) Helping customers save energy

The Group provides products and services that address climate change in accordance with the Design and Construction Standards and the Quality Manual. Thermal insulation performance rating* of level 4 (the highest level), double-glazed windows (end panel eco-glass), LED lighting fixtures, and other features are set as standard specifications for PROUD condominiums, and Environmental Assessment and Challenge Sheets are used to improve the environmental performance.

(4-4) Reduction of chlorofluorocarbons

To reduce the usage of ozone layer-depleting chlorofluorocarbons, the Group established a quality manual that requires the use of chlorofluorocarbon-free insulation and air conditioner refrigerants. Construction partners are also required to submit a Quality Control Check Sheet during construction to confirm that only chlorofluorocarbon-free materials are used.

(5) Low-carbon Buildings (Timber-based Construction, Absorption, and Fixation of CO2)

(5-1) Timber supply chain

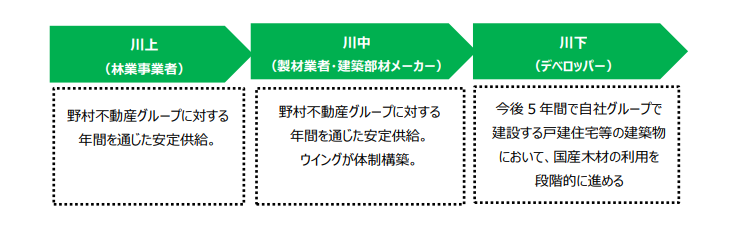

The self-sufficiency rate for timber in Japan is currently over 40% but remains low compared to other countries, and the Forestry Agency’s White Paper on Forestry and Forest Products has set a target of achieving 50% self-sufficiency in timber by 2025.

One reason for the low self-sufficiency rate is that the supply chain for domestic timber, from upstream to downstream, is not fully functional. Despite the rich domestic resources that are available, there are cases in which timber that has reached its usable age is not being felled due to a failure to secure a buyer.

In response, the Company has entered into an Agreement on the Promotion of Timber Use in Buildings with both the Ministry of Agriculture, Forestry and Fisheries and Wing Co. Ltd. to develop a stable supply chain from upstream to downstream for domestic timber. Over the next five years, we will gradually promote the use of domestic timber for construction materials in the Group’s businesses, using a total of 10,000 m3 of domestic timber before the agreement ends, while Wing Co. Ltd. will work in cooperation with logging, manufacturing, and processing companies nationwide to ensure a stable supply of domestic timber.

All businesses involved in upstream, midstream, and downstream of this supply chain will work together to promote the use of domestic timber, thereby revitalizing Japan’s mountain villages and maintaining the forest cycle. Through the initiative, we will also contribute to establishing a forest cycle that serves multifaceted functions, such as promoting the absorption and fixation of CO2 and preserving biodiversity.

(6) Renewable energy initiatives

(6-1) Solar power generation business in the logistics facilities

The Group is promoting the Solar Power Generation Business. As of the end of March 2023, solar panels were installed on a total of 19 buildings at Landport logistics facilities, with an annual output of 22,356 MWh/year in the entire portfolio.

| FY2019 | FY2020 | FY2021 | FY2022 | |

|---|---|---|---|---|

| Solar power generating facility installation rate at Landport logistics facilities (%) | 94.7 | 90.0 | 76.0 | 67.8 |

| Electric power generated at Landport logistics facilities (MWh) | 15,194 | 21,926 | 22,801 | 22,356 |

(6-2) Introducing solar power generation to detached housing

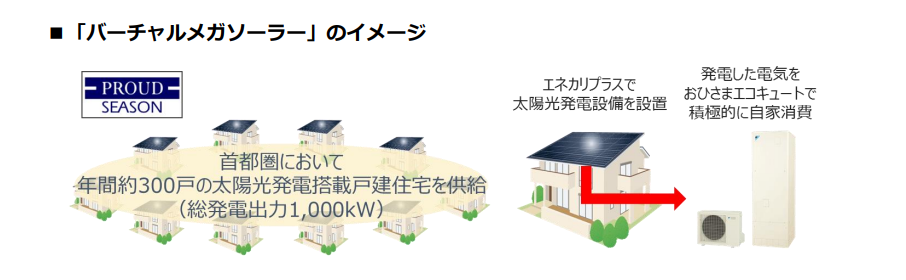

Using TEPCO Energy Partner’s solar PPA service “Enekari Plus” in May 2022, Nomura Real Estate Development launched the Virtual Mega Solar project, introducing solar power generation on the same scale as mega solar power plants (total power output of 1,000 kW) for PROUD SEASON detached housing developed by Nomura Real Estate Development, mainly in the Tokyo Metropolitan Area. This is the first initiative in Japan to introduce solar power generation with a total output of 1,000 kW to detached housing in the Tokyo metropolitan area (300 houses per year on the roof of the PROUD Season houses), and the two companies will promote this initiative for localized generation and consumption of electric power to conserve and generate energy in the Tokyo metropolitan area, where there are few areas of fallow land to be utilized.

By bringing in TEPCO EP’s Enekari Plus to approximately 300 PROUD SEASON houses of Nomura Real Estate Development per year, we will generate renewable energy, which achieves additionality on the same scale as mega solar power generation in residential areas in the metropolitan area. PROUD SEASON owners can use the energy generated by the solar power equipment for the duration of the Enekari Plus contract (ten years) without incurring initial or monthly costs. When the contract ends, they will also get to own the solar power generation equipment free of charge. Furthermore, using the solar power equipment in conjunction with an Ohisama Eco-Cute electric water heater promotes self-consumption of the generated electricity and reduces the amount of electricity purchased from the power company, thus suppressing the rise in electricity and gas bills caused by recent fuel price hikes. In the event of a disaster, they can continue to use electricity during the hours when solar power generation can take place, as well as the hot water stored in the Ohisama Eco-Cute for general household use, making their lives more secure.

(6-3) Use of renewable energy

All of the electricity procured for all Noga Hotels operated by Nomura Real Estate Hotels, one of the Group’s businesses, Garden Hotels operated by UHM, a Group company, and MEFULL, a commercial facility specializing in services developed by Nomura Real Estate Development, is practically 100% renewable under the Zero CO2 Plan provided by NF Power Service, a retail electricity provider and Group affiliate. In fiscal 2022, combined with other buildings, a total of 68.82 million kWh of renewable energy was procured via this plan. In addition, we purchase one million kWh of green electricity per year for the Nihonbashi Muromachi Nomura Building.

(7) Initiatives for the Shibaura 1-chome Project

The Shibaura 1-chome Project is a phased reconstruction project of a large-scale complex of offices, commercial facilities, hotels, and other facilities in Minato-ku, Tokyo, and it has been approved as a national strategic special zone.

Under the theme of creating a city for healthy and comfortable living, the project aims to realize both the ideal state of the next generation of tenant buildings and CO2 reduction by realizing a Wellness Office, achieving ZEB Oriented through various energy-saving measures and ultimately becoming carbon neutral by introducing electricity derived from renewable energy sources in the future. In recognition of this plan, the project was selected by the Ministry of Land, Infrastructure, Transport and Tourism as the leading projects program for sustainable buildings (CO2 reduction type) in 2021.

Sustainability

- The Nomura Real Estate Group’s Stance on Sustainability

- Climate Change and the Natural Environment

- Society and Employees

- ESG Data