- HOME

- Investors Relations(securities code:3231)

- Financial Information

- Major Performance Indicators

Major Performance Indicators

(*)Please refer to Outline of Consolidated Financial Statementsor quarterly data.

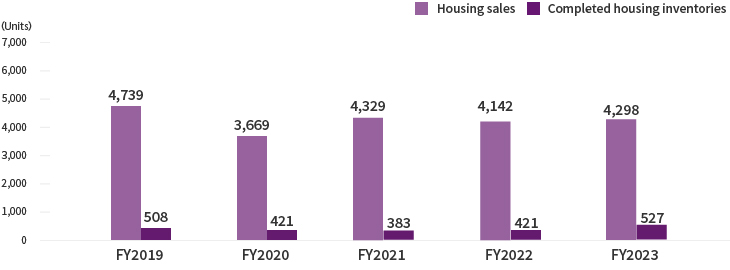

Residential Development Business

| FY2019 (Apr. '19 -Mar. '20) |

FY2020 (Apr. '20 -Mar. '21) |

FY2021 (Apr. '21 -Mar. '22) |

FY2022 (Apr. '22 -Mar. '23) |

FY2023 (Apr. '23 -Mar. '24) |

|

| Housing sales (units) | 4,739 | 3,669 | 4,329 | 4,142 | 4,298 |

| Completed housing inventories (released for sale) (units) | 321 | 239 | 130 | 222 | 248 |

| Completed housing inventories (unreleased) (units) | 187 | 182 | 253 | 199 | 279 |

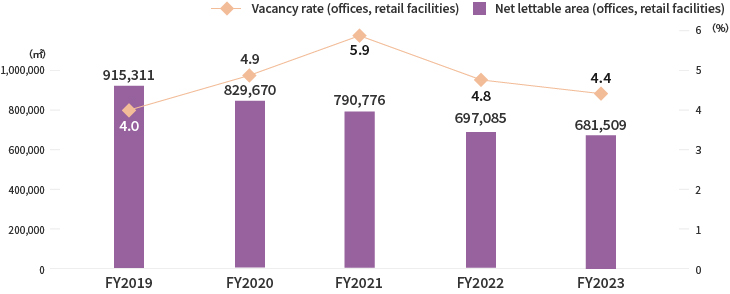

Commercial Real Estate Business

| FY2019 (Apr. '19 - Mar. '20) |

FY2020 (Apr. '20 - Mar. '21) |

FY2021 (Apr. '21 - Mar. '22) |

FY2022 (Apr. '22 - Mar. '23) |

FY2023 (Apr. '23 - Mar. '24) |

|

| Vacancy rate (offices, retail facilities)(*1) | 4.0% | 4.9% | 5.9% | 4.8% | 4.4% |

| Net lettable area (offices, retail facilities) (sqm)(*1) | 915,311 | 829,670 | 790,776 | 697,085 | 681,509 |

(*1)As of April 1, 2022, Nomura Real Estate Development Co., Ltd. and Nomura Real Estate Building Co., Ltd. were merged (Nomura Real Estate Development Co., Ltd. as the surviving company), and partial revision was made to the method used to calculate the net lettable area and the vacancy rate in Commercial Real Estate Business Unit. Due to this change, Due to this change, the figures listed are changed.

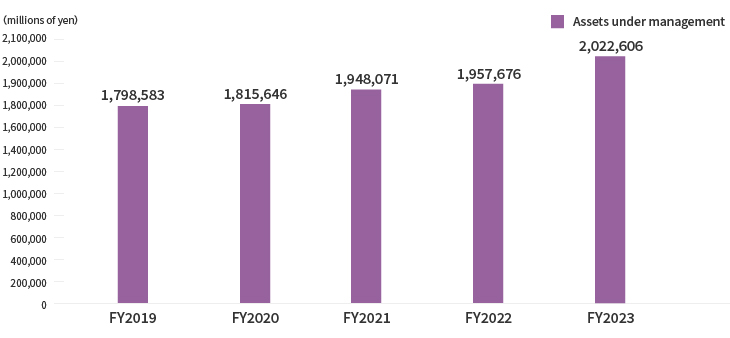

Investment Management Business

| FY2019 (Apr. '19 -Mar. '20) |

FY2020 (Apr. '20 -Mar. '21) |

FY2021 (Apr. '21 -Mar. '22) |

FY2022 (Apr. '22 -Mar. '23) |

FY2023 (Apr. '23 - Mar. '24) |

|

| Assets under management (millions of yen) | 1,798,583 | 1,815,646 | 1,948,071 | 1,957,676 | 2,022,606 |

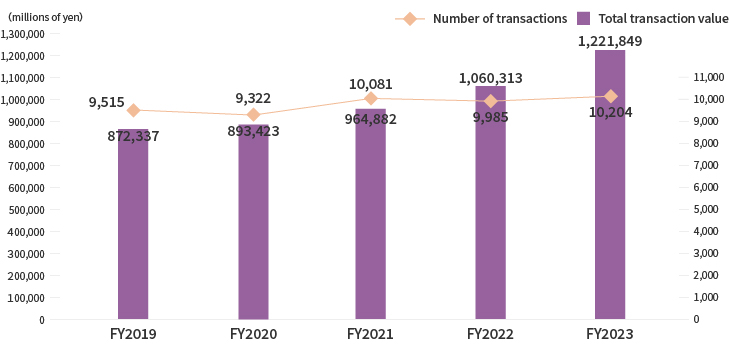

Property Brokerage & CRE Business

| FY2019 (Apr. '19 -Mar. '20) |

FY2020 (Apr. '20 -Mar. '21) |

FY2021 (Apr. '21 -Mar. '22) |

FY2022 (Apr. '22 -Mar. '23) |

FY2023 (Apr. '23 - Mar. '24) |

|

| Brokerage: Number of transactions | 9,515 | 9,322 | 10,081 | 9,985 | 10,204 |

| Brokerage: Total transaction value (millions of yen) | 872,337 | 893,423 | 964,882 | 1,060,313 | 1,221,849 |

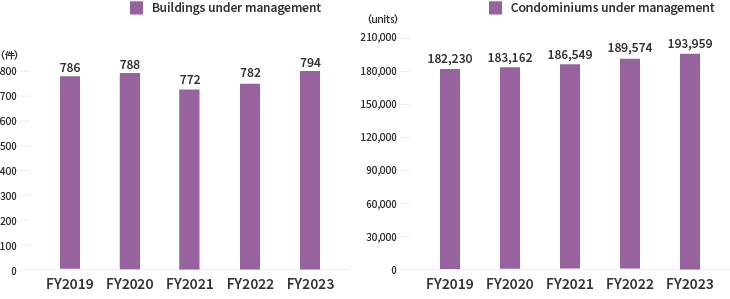

Property & Facility Management Business

| FY2019 (Apr. '19 -Mar. '20) |

FY2020 (Apr. '20 -Mar. '21) |

FY2021 (Apr. '21 -Mar. '22) |

FY2022 (Apr. '22 -Mar. '23) |

FY2023 (Apr. '23 - Mar. '24) |

|

| Buildings under management (*1) | 786 | 788 | 772 | 782 | 794 |

| Condominiums under management (units) (*1) | 182,259 | 183,162 | 186,549 | 189,574 | 193,959 |

(*1)As of April 1, 2020, NREG TOSHIBA BUILDING FACILITIES Co., Ltd., which had been classified under the Commercial Real Estate Business Unit, has been merged with Nomura Real Estate Partners Co., Ltd. which has been classified under the Property & Facility Management Business Unit. The merger has been carried out with NREG TOSHIBA BUILDING FACILITIES Co., Ltd. being the absorbed company and Nomura Real Estate Partners Co., Ltd. being the surviving company. In line with this change, the results for the fiscal year ended March 31, 2020 are based on the changed classification under the new classification of business unit after the merger.

Investors Relations

- Management Policy

- IR Library

- Financial Information

- Stock and Bond Information

- IR information