- HOME

- Investors Relations(securities code:3231)

- Management Policy

- Mid- to Long-term Business Plan

Mid- to Long-term Business Plan

Announcement of the formulation of Nomura Real Estate Group Mid- to Long-term Business Plan

Nomura Real Estate Holdings, Inc. hereby announced that Nomura Real Estate Group (the "Group") has formulated a new mid- to long-term business plan (hereinafter referred to as "the plan") for the period from FY23/3 through FY31/3.

Background and Purpose of this Plan

The Group formulated a mid- to long-term business plan (hereinafter referred to as "the previous plan" for the period from FY20/3 through FY28/3) in April 2019 and it was promoted with the target of achieving 85.0 billion yen in business profit*, ROA of around 4 to 5%, ROE of around 8 to 9%, and a total return ratio of around 40 to 50% for FY22/3.

As a result, the Group achieved our goals of 92.7 billion yen in business profit, ROA of 4.7%, ROE of 9.2%, and total return ratio of 44.3% for FY22/3.

Meanwhile, the business environment surrounding the Group has changed day by day with increasing complexity and uncertainty, such as the diversification of people’s lifestyles and values, the accelerated advancement of digitalization in day-to-day lifestyles, and heightened geopolitical risks.

In order to achieve sustained high profit growth in future in such a business environment, the Group believes it is necessary to clarify its vision of "what kind of value do we want to provide to society and customers in the future as a corporate group" and to evolve and transform value creation approaches and methods based on this vision.

Based on the recognition of these issues, we have formulated the plan and, at the same time, a vision for the Group targeting the year 2030.

* Business profit = operating profit + share of profit (loss) of entities accounted for using equity method + amortization of intangible assets associated with corporate acquisitions

Nomura Real Estate Group 2030 Vision

Be a "Life & Time Developer," as never seen before

Nomura Real Estate Group has always connected closely

with customers’ lives and time, through real estate development and real estate-related services.

Now, as we confront various social issues,

as well as diversified lifestyles and values,

we must change ourselves.

To enrich people’s respective lives and every moment of their time,

we will transform ourselves into a "Life & Time Developer"

that creates new, significant values on a global scale.

Under this vision, the plan aims to realize both high profit growth with high asset and capital efficiency, and we have positioned further expansion of domestic real estate development business, high profit growth of Service & Management Sector, and steady growth of overseas business as our key strategies. We will firmly return the results of the Group’s growth through this plan to our stakeholders.

Profit Plan

| Phase 1 (FY25/3) | Phase 2 (FY28/3) | Phase 3 (FY31/3) |

|

|---|---|---|---|

| Business profit* | 115.0 billion yen | 140.0 billion yen or more | 180.0 billion yen or more |

| Annual average growth rate | 8% level | ||

* Business profit = operating profit + share of profit (loss) of entities accounted for using equity method + amortization of intangible assets associated with corporate acquisitions

ROA, ROE and Shareholder returns

| Phase 1 (FY23/3 to FY25/3) | Phase 2 (FY26/3 to FY28/3) | Phase 3 (FY29/3 to FY31/3) |

|

|---|---|---|---|

| ROA* | 4.5% level | 5% level | 5% or more |

| ROE | 9% level | 10% level | 10% or more |

| Shareholder returns | Total return ratio of 40-50% | Payout ratio at 40% level | |

* ROA = business profit / total assets during period (average)

Sustainability Policy

In addition, taking changes in the management and business environment, such as the diversification of people’s values and global issues like climate change and the increased severity of disasters, as new opportunities for growth, the Group has formulated the Sustainability Policy "Earth Pride" as the vision of what the Group wants to be in 2050.

Sustainability Policy

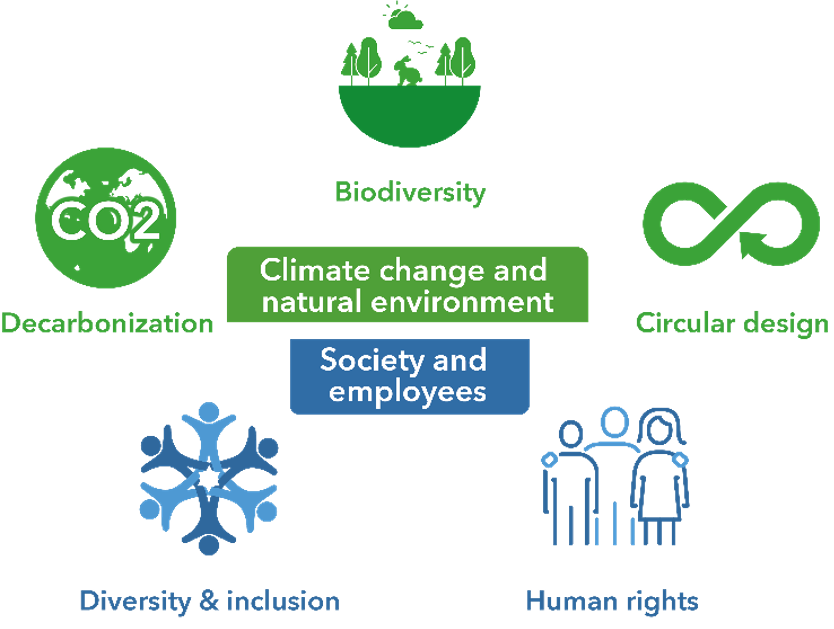

Priority Issues(Materiality) by 2030

Strengthening promotion foundation

・Respect for the human rights of our employees and all people involved in our business

・Engagement with business partners based on the Nomura Real Estate Group Human Rights Policy

・Create an organization in which diverse personnel with a variety of backgrounds and values can demonstrate their abilities

・Initiatives aimed at co-creation of diverse organizations and human resources within and outside the company

・Establish the Human Resource, Wellness, D&I Committee (Chair:Group CEO)

・Establish the D&I Management Sect. in the Human Resources Development Dept. as the dedicated management organization

Reduction of total CO2 emissions by 2030 (Science Based Target : 35% reduction)

・Improve energy conservation performance in new buildings (ZEH/ZEB Oriented standards)

・Implement renewable energy solar power plants in our development properties to achieve RE100 (detached housing, Landport, etc.)

・Initiatives for carbon neutrality through urban development such as Shibaura 1-chome Project

・Promote use of low-carbon materials (timber-based buildings, etc.)

・Initiatives to conserve biodiversity and absorb carbon dioxide through greening of urban areas and forest circulation activities, etc.

・Further efforts to develop products and services to realize a circular economy (building longevity, waste reduction and recycling, etc.) such as "Attractive 30" for extending the cycle of large-scale repair work.

"Earth Pride" is based on three themes that the Group values: "Pursuing humanity," "Maintaining harmony with nature," and "Building the future together." We have identified five priority issues (materiality) that we particularly want to address by 2030 in order to achieve this Sustainability Policy. In addition, in order to track our progress in these priority issues, we have set indicators (KPI)* to measure our performance with regard to issues such as climate change, human rights, and diversity.

The Group will continue to work on new value creation through co-creation with diverse organizations and human resources within and outside the company as our driving force, and to contribute to realize a sustainable society.

Reference

Mid-to Long-term Business Plan

from FY23/3 through FY31/3

- Announcement of the formulation of Nomura Real Estate Group Mid- to Long-term Business Plan

- Presentation Material of the Mid- to Long-term Business Plan

Mid-to Long-term Business Plan

- from FY20/3 through FY28/3

- Notice of the Mid- to Long-Term Business Plan Prepared by the Nomura Real Estate Group

- Presentation Material of the Mid- to Long-Term Business Plan

- from FY17/3 through FY25/3

- Notice of the Mid- to Long-Term Business Plan Prepared by the Nomura Real Estate Group

- Presentation Material of the Mid- to Long-Term Business Plan

Investors Relations

- Management Policy

- IR Library

- Financial Information

- Stock and Bond Information

- IR information